Date03.03.16

AuthorJohn Davey

CompanyDar Al-Handasah

The Value of Natural Capital

In 1937, Franklin D. Roosevelt opined that “real wealth” in land and minerals was being converted to “nominal wealth” in bank balances at a rate faster than it could be replaced. Eight decades of unsustainable development later, we’re beginning to appreciate the monetary value inherent in the earth’s stock–stock in which we are all shareholders, our natural capital that is more inclusive than land and minerals.

Natural capital comprises the goods and services that sustain the global economy: goods such as the air we breathe, the water we drink, the stone and timber with which we build, and the crops and fish we eat; services such as the dispersion of exhaust emissions, the dilution of effluent discharges and the adsorption of carbon. There is no charge for an aquifer to collect rainfall, filter it and make it available for human consumption; no charge for a tree to take in carbon dioxide and give out oxygen. Nature provides these goods and services for free. Economists call them externalities, vital to the success or failure of a business but rarely found in business plans or annual accounts.

Charles Dickens famously wrote: “Annual income twenty pounds, annual expenditure nineteen pounds nineteen shillings and sixpence, result happiness. Annual income twenty pounds, annual expenditure twenty pounds and sixpence, result misery.” As with financial capital, if we regularly replenish our bank accounts and live within our means, our lifestyle is sustainable. If we overspend, we go bankrupt and our lifestyle is degraded. When we draw on natural capital, we also need to replenish: replant our forests, recharge our aquifers and restock our fisheries, or our environment is degraded. Business-as-usual since the start of the Industrial Revolution has been to draw down our natural capital without replenishment. To continue risks ecological bankruptcy.

In the late 1990s, when China’s growth seemed unstoppable, deforestation in the Yangtze basin continued unabated until it was banned when flooding and landslides killed over 5,000 people. It was subsequently calculated that the value of eroded topsoil, lost farm productivity and loss to the local community was twice what the timber fetched on the international market. As long ago as 1997, the World Resources Institute estimated the natural products harvested by the global pharmaceutical industry to be valued at more than $80 billion. The value of bees to pollinate fruit trees is put at $190 billion each year, 8% of global agricultural output.

The more you save, the more you can spend. The more forests you preserve, the greater the capacity to sequestrate carbon; the more fisheries you conserve, the more you can draw on them to feed growing populations. Overspend, and you lose not only the capital but also the accrued interest. Fell trees for timber, and you not only reduce the capacity to absorb carbon but make the timber give out what it had previously taken in; drain wetlands and clear mangrove, and you reduce nature’s provision for flood alleviation and storm protection. In Sri Lanka, in the days and weeks after the tsunami, I saw first-hand the financial and human cost of replacing wave-dissipating mangroves with waterfront villas that crumbled when inundated and allowed the sea to surge inland.

Nature may be priceless, but it is not valueless! The UN’s Reducing Emissions from Deforestation and forest Degradation (REDD) initiative has estimated the cost of preserving 90% of the world’s remaining forests to be $20 billion per year, yet the ecological services they provide – air and water purification, soil protection, flood alleviation, and carbon absorption – they’ve valued at $4.5-5 trillion per year. And it’s not only the tropical forests. London’s trees are estimated to be worth $6.1 billion, and throughout the UK, 1 ha of public green space is worth $1,000 per person per year solely in health benefits.

Mangrove in Thailand was once unvalued, and the government supported its clearance for shrimp farming. Over the period of one study, the natural mangrove was estimated to be worth $600; the shrimp farm, $9,600. But $8,000 came in the form of government subsidies, and the profit from shrimping was only $600-1,200. When the value of the mangrove for storm protection and fish spawning was factored, its value increased to $11,000 – a clear case for conservation and public wealth over destruction and private profit.

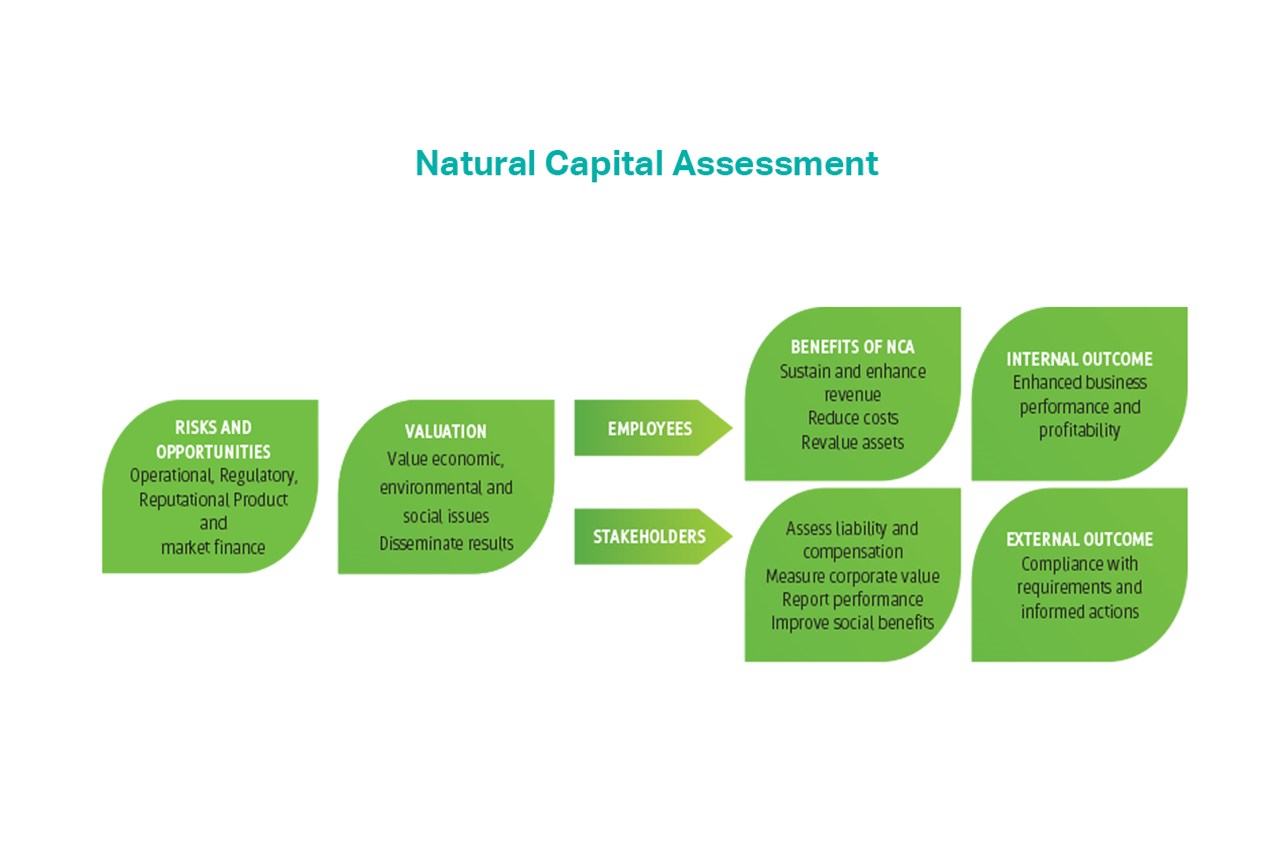

In the absence of prudent financial management, bankruptcy brings economic and social consequences. In the absence of prudent environmental management, ecological bankruptcy ultimately brings starvation due to the failure of food crops, conflict for the control of scarce natural resources and population displacement. In a world in which future resource availability will be increasingly constrained and will come to account for a larger portion of business overheads, it is vital we understand how natural capital influences productivity and profitability. The limits on corporate growth are no longer just the internalities of labour, capital and technology. The challenge is to make the environmental externalities visible to decision-makers, for businesses big and small; to understand the extent to which they are natural capital dependant; and to adopt natural capital accounting (NCA) to secure, improved performance and profitability within a framework of regulatory compliance.

With environmental externalities provided for free to the top 3,000 global businesses valued by the UN at $2.1 trillion, financial advisor KPMG in its recent report “Expect the Unexpected” estimates that companies stand to lose 41 cents in the dollar, every dollar, if they pay for these externalities. Coupled with the prediction that sustainability-related global business opportunities in natural resources may reach $2-6 trillion annually by 2050, the valuation of ecological goods and services will be a game-changer. Business leaders will understand their responsibilities and ignore them at their peril.

There are several initiatives for the promotion of NCA. Corporate Ecosystem Valuation, a framework for improving corporate decision-making, is the brain child of the World Business Council for Sustainable Development (WBCSD), while the World Bank Group has established Wealth Accounting and Valuation of Ecosystem Services (WAVES ) to link NCA, government and corporate policy with decision-making to look beyond GDP for a more inclusive assessment of growth and the well-being of society.